Consulting for small businesses across verticals affords me the ability to continuously learn. I am exposed to a number of industry specific challenges, but periodically find myself faced with a recurring problem faced by clients across all industries. Recently I have seen numerous clients confronted with the difficulty of properly projecting cash flows and understanding how to distribute accounts receivables to ensure long-term growth. As such, I have organized two individual posts to review the strategies I suggested.

This post will examine the importance of projecting cash flows, the process to determine sales cycles, how to segregate individual target audience segments, and how loss-lead products can ensure both qualified leads and larger upsells. The next post will discuss how CNSLT.us, my consulting firm, has successfully delayed cash flows to secure long-term growth – an atypical strategy.

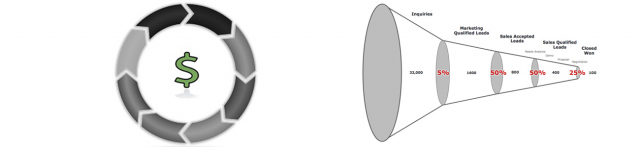

Once a new business’s sales process is standardized it is essential to analyze its results to continuously improve the sales strategy and properly project cash flow. The sales cycle is a particular order in which a potential customer learns about your product or service, and ultimately decides whether to purchase. Understanding the conversion rates between stages and the time it takes to successfully walk a prospect through the entire process allows new and small businesses to determine pitfalls and accurately project future cash flow, respectfully.

Depending on the firm’s product and service offerings the sales cycle varies. For the purpose of this post we will use CNSLT.us as an example. Defining a value add for our retainer services (i.e. market research, strategy development, online ad buys, online reputation management, product launches, etc.) is difficult without a tangible sales tool. While the majority of clients signed on based on both recommendations and our proven track record, CNSLT.us realized a number of prospects were hesitating before they fully understood the potential result of our work. As a result, the firm developed internal tools included in our retainer, but also available as stand-alone products.

CNSLT.in & CNSLT.bz were designed and developed based on industry specific needs as a lead generation tool for CNSLT.us’ services.

After analyzing the result of initial interactions with cold prospects, CNSLT.us determined that offering both CNSLT.in & CNSLT.bz as individual products at a low monthly cost would be perceived as a tangible product. The potential retainer client who would have otherwise been a lost sale (1/20 advanced to an in-person meeting), converted to a paid product subscriber (5/20) – resulting in additional monthly revenue and increased conversion rate of cold prospects into qualified retainer prospects.

Understanding the percent of deals within a given stage that result in a sale, also known as deal probability, is essential to determining future cash flow. Identifying a high percent of sales lost between individual stages is necessary to address and improve the sales strategy. CNSLT.us vastly improved deal probability (roughly 400% increase) by adding in product demonstration early on in the sales cycle. Another example of a strategy improvement is the absence of decision-makers from the potential client company during a sales meeting. Ensuring the presence of all necessary parties may result in a faster sales cycle with a higher success rate.

Segmenting the sales cycle between sourcing prospects and qualified leads allows for a firm to more accurately project the length and value of each entire cycle and individual stage. CNSLT.us determined that the best strategy to identify qualified sales leads was to initiate contact by introducing CNSLT.in & CNSLT.bz. Once a potential lead was interested in either product, an in-person meeting allowed for a salesman to 1) close the sale on a product or 2) immediately upsell our retainer services. However, a majority begins their working relationship with CNSLT.us as monthly subscribers to one of our products.

Once a client is remitting payment to CNSLT.us for one (or both) of its products on a monthly basis, it is converted to a qualified lead and positioned in step one of our retainer sales cycle: an Introduction to CNSLT.us Services. The entire sales cycle timeline can be determined by examining the last month of closed deals. Find the number of new clients signed, determine the length of their individual sales cycles, and take the average (i.e. 3 deals; each one took 3 months, 4 months, and 5 months, respectfully; total of 12 months, divided by 3; average of 4 months = sales cycle).

Understanding the average deal value, the sales cycle, and deal probability at each stage of your pipeline allows for a business to identify the number of prospects it needs to contact on a monthly basis to retain positive cash flow (for a fun tool, check out The NO Calculator). Proper projections enable businesses to finance equipment and human capital (future monthly wages) – resulting in continuously growing business.