Determining a viable Customer Acquisition Strategy is highly dependent on cost. To reiterate, compared to the Customer Acquisition Cost (CAC), the Lifetime Value (LTV) of a customer needs to meet or exceed the CAC to remain a sustainable business.

If you want to stay in business forever, increase the LTV of your customer. A customer’s Lifetime Value is based on the average revenue per customer, average customer lifetime, and the annual costs to support each customer. Ignoring costs, this presents you with two opportunities.

Average Revenue Per Customer

A business owner has numerous options to increase average revenue per customer depending on the industry and product. As an example, upsells allow for businesses to remind clients of services they might not otherwise have known are offered. While upsells within restaurants may be obvious (i.e. “Would you like fries with that?”), other industries – including services – can turn even the most reliable customer into a more valuable one:

“Kelley Briggs, CEO of DesignWorks NY, a graphic design and marketing communications firm in Westchester County, New York, sends a personal letter to every customer once a year. She includes a list of her services with the ones they’ve used check off. ‘It reminds them of the types of projects we’ve worked on in that past year and shows them what services they did not use,’ she says. ‘It’s an excellent cross selling tool.’ In recent years, clients who received the letter have signed on for additional projects such as annual reports, website design, and marketing strategy.”

– Donna Fenn, Inc.com

Average Customer Lifetime

Determining a strategy to extend an existing relationship with a customer will ensure future cash flows for the business. Maintaining an ongoing relationship with a customer, rather than just a single sale, can be achieved through several methods.

At CNSLT.us, we focus on providing ancillary support services even when contracted on a project basis – versus a retained client. For such projects (i.e. mobile site design and development), a standard agreement outlines initial consultation, preliminary designs, approval of final designs, development of a staging site, quality assurance, and finally, the completion of the contract. However, CNSLT.us focuses on acquiring and retaining clients. Thus, our project-based sales process and contracts include ancillary services that prolong the customer’s relationship.

Examples of such services include hosting, ongoing support, monthly design work, and various upsells (analytics reporting, online advertising campaign setup and management, newsletter management, etc.).

Other businesses, across industries, can provide similar support services to retain otherwise onetime customers. For example, a software firm with a product offered as a download for a fee would typically have one touch-point per client. However, if the business offers monthly support for a nominal fee, it can greatly increase not only its average revenue per customer, but also its average customer lifetime.

As a result of providing ongoing support services as a value add, it has been CNSLT.us’ goal to create customer dependence. The concept is that, by offering continued services, clients are more likely to remain customers over time because of the positive experience, trust, and developed understanding.

Properly projecting the average customer Lifetime Value allows for future cash flow projections as well as an understanding of customer turnover. The churn rate represents the number of customers that will end their contracts over a given amount of time. Correctly identifying when new customers must be retained to replace the lost once ensures continued growth.

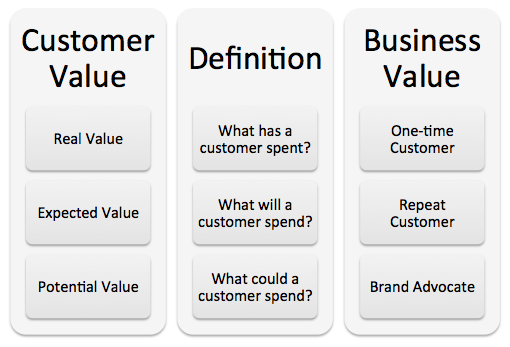

All customers are divided into real, expected, and potential value. The following chart represents how each of these segments aligns with a customer as she is converted from a one-time shopper, to a repeat customer, to a highly valued brand advocate. Cultivating repeat customers with strong brand affinity increases the average customer’s Lifetime Value.

When projecting customer lifetime value it is beneficial to understand the cost of replacement versus the cost of retention. By analyzing this factor, a business can determine the amount of effort necessary to retain current clients before accepting a loss and replacing them with a – typically more expensive – new sale. A strategy to retain current clients may include providing discounted products or services to continue the relationship. However, measuring the potential return of discounted continued services compared with a new contract, signed at current standard rates, will allow for a more informed decision, resulting in the greatest gain for the business.

All in all, understanding and properly projecting customer Lifetime Value makes it possible for an organization to manage sales, budget expenses, and determine future growth. In addition, understanding the variables that affect average customer lifetime and average revenue per customer can enable a business to shift its products, services, and even its marketing (find value add) to increase potential returns.